Blog Post

Build Your Pipeline Now: 5 Mortgage Rate Scenarios Agents Should Prep For

September 30, 2024 written by Fello

After weeks of rumors, on Wednesday, September 16, 2024 the Federal Reserve cut rates by 50 basis points (0.50%) in an early attempt to revive a slightly cooling economy and slightly rising unemployment rates (by the standard U-3 rate, not the more inclusive U-6). While we haven't seen rates drop dramatically, they're forecasted to be cut again (maybe 2X) before the end of 2024.

All that said, there is no better time than right now for real estate agents to prepare for various market and rate scenarios that could impact their businesses. Another note, we're not economists, just fans of the economy and avid readers. We're sharing information, not financial or business advice. Talk to your financial or legal advisor if you have questions about the impact to your business.

Here are five potential outcomes to keep on your radar, plus some suggestions on how to prepare:

Scenario 1: Increased Demand Drives Up Home Prices

Lower mortgage rates typically stimulate buyer interest, but this surge in demand could lead to higher home prices. Basic supply and demand theory dictates that if there are more buyers than supply, agents and sellers will see higher prices or more sales.

Agents should be prepared to guide clients through potentially competitive bidding situations and help sellers price their homes strategically. The MOFIR strategy could also be very impactful in a lower-rate environment.

Scenario 2: Increases in Delistings and Price Adjustments

According to real estate strategist Mike Delprete, we're currently witnessing record-high numbers of homes being delisted (put up for sale and then taken off the MLS without selling) and an increase in price reductions. Nationally, delistings are nearly the double the typical rate. Homes are also spending more time on the market, and the price per square foot is at an all-time high.

Agents should be prepared to have frank discussions with sellers about realistic pricing and potentially help them re-list at more competitive rates with stronger marketing.

Scenario 3: More Housing Supply

Lower interest rates could incentivize homebuilders to increase production, particularly of more affordable starter homes. The rates could also help smaller developers to secure loans for new projects. Don Payne, a real estate agent in Columbus, OH, told NPR, "Folks are trying to get their first house, and there's a huge shortage on that." Depending on where you look, the affordable housing shortage in the U.S. ranges anywhere from 4 million to 7 million units.

Agents should stay informed about new developments in their areas and be ready to guide first-time homebuyers through the process of purchasing new construction.

Scenario 4: Mortgage Rates Don't Drop Much Further

Despite the Fed's rate cut, we might not see significant drops in mortgage rates in the immediate future. Wells Fargo economists stated they expect further rate drops to be marginal after the Fed's initial rate cut, and are forecasting the average 30-year fixed-rate mortgage will remain around 6.2% by year-end, potentially falling to 5.5% by the end of 2025 — still above pre-pandemic levels.

Scenario 5: Affordability is Still a Big Problem

While lower mortgage rates can reduce monthly payments, affordability may still be a significant challenge due to sky-high home prices. Here's why:

- Rapid price growth: Home prices have risen by about 50% since early 2020, well outpacing average household income growth.

- Locked in low rates: During the pandemic, many homeowners refinanced at record-low rates. More than 60% of active mortgages now have rates below 4%, making these homeowners reluctant to sell and take on a higher rate mortgage. However, as Tom Ferry said in our webinar, if your favorite thing about your home is the rate, we need to talk.

- Persistent inventory shortages: Even though mortgage rates have decreased recently, it hasn't significantly stimulated the housing market. Home prices are still high, and supply is still below pre-pandemic levels.

How Real Estate Agents Can Prepare

Given these potential scenarios and the current market, here's how you can position yourself for success, regardless of rates or market conditions:

- Educate clients: Help buyers and sellers understand the complex relationship between Fed actions and mortgage rates. Explain that while rates may fluctuate in the short term, the overall trend is likely to be downward.

- Stay informed: Keep up-to-date on economic indicators, Federal Reserve announcements, and your local market trends to provide valuable insights to your clients. We like to watch Bankrate, HousingWire, ZondaHome, and FRED.

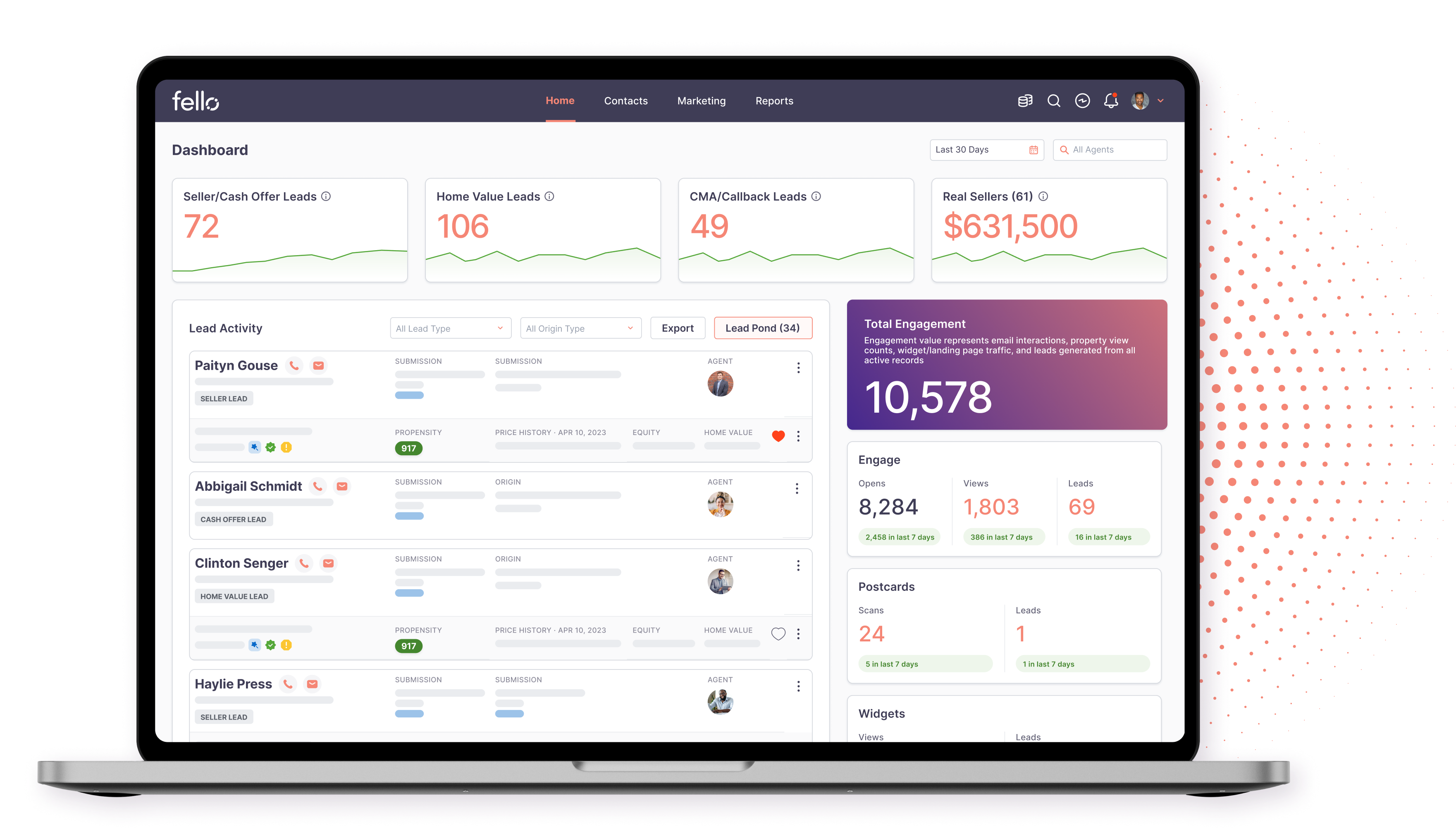

- Build your pipeline: Use this time to nurture your database and identify potential sellers for 2025. This is where Fello can help you. Our marketing automation, AI, and strategy tools are completely dedicated to helping you uncover warm seller leads in your database, helping to boost your efficiency, productivity, and revenue). Regardless if we see more rate cuts or not, your pipeline should be in a healthy place with a group of homeowners who need your services.

- Develop niche expertise: Whether it's new construction, first-time homebuyers, retirees, or luxury markets, focus on becoming an expert in areas likely to see increased activity as rates potentially decrease.

- Offer value beyond transactions: In a changing market — one with many lingering questions post NAR-settlement — clients need guidance more than ever. Position yourself as a trusted advisor who can help navigate complex market conditions, whether the client is buying or selling.

- Be ready for quick changes: As we've seen over the past few years, market conditions can shift rapidly. Develop strategies to act quickly when opportunities arise or when clients need to pivot their plans.

Remember, while the current rate environment is complex, it presents opportunities for savvy agents who can guide their clients through shifting market conditions — and build a pipeline to market-proof their businesses. By staying informed, adaptable, and client-focused, you can turn these challenges into opportunities for growth and success.

— — —

If you aren't a Fello user yet, book a demo to see how Fello can help you build your pipeline to find contacts who have high mortgage rates or are requesting cash offers for their homes.

Sources:

https://www.housingwire.com/

https://www.mikedp.com/

https://www.npr.org/

https://andreasmueller.substack.com/

https://www.cbsnews.com/

https://www.bankrate.com/

https://www.cnbc.com/

Ready to start driving more seller leads on autopilot?